Get Help With Auto Repair and Loss

Property Damage Claims

Insurance companies view property damage and personal injury claims as two separate issues. Property damage includes your vehicle and any other physical losses to possessions. Most state laws entitle the victim to either the cost of repairs or the fair market value of the car if it’s been totaled. Totaled, short-hand for total loss, describes a vehicle with repair costs greater than a certain percentage of the car’s value. That percentage can be as low as 51 percent to as high as 90 percent.

When insurance deems the car totaled, the insured party is paid cash value for the vehicle. The actual cash value (ACV) is the cost of a similar vehicle. After insurance subtracts a variable amount for age and normal wear and tear from the ACV, the remaining amount is paid to the insured party. Unfortunately, many state laws don’t require insurance companies to award the value of a replacement vehicle.

If your insurance includes property damage liability, then any damage you may have caused to the other vehicle as well as the possessions of the other party are covered. This covers any property lost in the accident, which may include trees, fences, garage doors or whatever else.

Third Party Claims

There are two kinds of claims: first party and third party. First party claims are filed with your insurance carrier. Third party claims are filed against others in the accident. It may be another driver, the manufacturer of defective products, a property owner or some other negligent party. The other party must be at fault for the accident to file a third party claim. When you file this type of claim, the other insurance company investigates and decides whether to pay the claim, negotiate or defend their customer.

Collision Coverage Claim

If you have an insurance policy with collision coverage, your vehicle’s repair will be paid for by insurance no matter who was at fault. This is generally the most expensive type of auto insurance. The insurance company awards you the actual cash value of your car. For older cars with lower values, it may be better to forgo this type of coverage because of the high premium and the cost of a replacement vehicle is greater than what you would be given by the insurance company.

Before you file a claim with your insurance company, consider the cost of the damage to your vehicle. If repairs would be less than your deductible and no one else was part of the accident, it would be easier and possibly cheaper to simply pay the cost of repairs out-of-pocket.

Repair Amount Compensation

Insurance companies often assign their direct repair shop in order to assess the vehicle’s damage. Your policy may also cover the cost of a rental car to use while your vehicle is undergoing repairs. It’s your choice to find your own repair shop if you choose. Make sure to get a written estimate of the costs because once you allow the repair shop to begin work on your vehicle, they can’t charge any more than 10 percent higher than the initial quote.

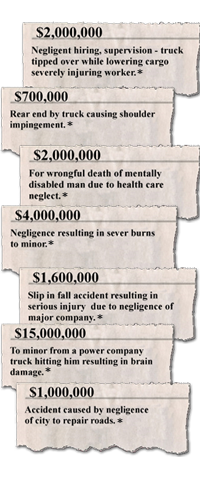

EXPERIENCE • RESOURCES • RESULTS

Call Now

iAccident Lawyer

Tax-Free Settlements

"No matter how long we talk or how many times you call back, there is no charge."

(800) 570-9850

Donald Stevenson, Esq.

iAccident Lawyer

(800) 570-9850

| Home | No Recovery No Fee |

Testimonials | Help With Auto Repair |

Help With Medical Bills |